Rental property amortization schedule

To download the free rental income and expense worksheet template click the green button at the top of the page. No seasoning no tax returns no income verification low rates 30 year term with 3 or 5 year interest only option.

A Guide To Property Depreciation And How Much You Can Save

Compare Comparable Sales prices Rental Income Capitalization Rates to determine the fair market values of your property.

. As per Wiki In banking and finance an amortizing loan is a loan where the principal of the loan is paid down over the life of the loan that is amortized according to an amortization schedule typically through equal payments In simple terms Amortization happens when you pay off a debt over time with regular equal payments. It can be in another city. Insert the name of the tenant.

Fully amortizing over. Once depreciation for the year has been calculated it can be entered into Schedule E for the depreciation line item. For additional information on depreciation refer to Publication 946 How To Depreciate Property.

Enter the contact details. Section 179 deduction dollar limits. Create a detailed rental property description.

Tax-free exchange of rental property occasionally used for personal purposes. For example assume you bought the same 100000 rental property as above but instead of paying cash you took out a mortgage. The upper half of the screen is for income for that rental property the bottom half for expenses.

In step-by-step go to the page for the specific rental property ie 1234 Maple Street. Schedule E has enough room for three rental properties. Amendment 4 1904 Art.

4562 Depreciation and Amortization. I use to dread filing taxes the head-ache using TurboTax has. Temporary meal expense deduction in-crease for 2021 and 2022.

Insert the property number or ID in which the tenant lives. The new property managers will most likely require a pre-agreement inspection or even do one. Insurance Line 9 6.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Interest-only for five years followed by 25-year amortization schedule. Texas premiere rental property lender.

Depending on the type you can make payments accordingly on the basis of the compounding interest. List your total income expenses and depreciation for each rental property on the appropriate line of Schedule E. Property 1 Property 2.

Followed by 27-year amortization schedule. Line 7 I owned a homeproperty in California. Inspection before changing property management.

But the liberty of conscience hereby secured shall not be so construed as to excuse acts of. As you can see the amount of equity in the property 5 years after purchase assuming a 30-year amortization schedule and 1 per year appreciation is 47898. Schedule F Form 1040 lines 4a and 4b.

These rental property tax deductions are above the line deductions meaning they come directly off your taxable income for rental properties. Enter your most recent period of California residency. Just like a lackluster resume or a poorly written college application essay a mediocre rental listing can easily get lost in the crowd.

Depreciation is entered into Form 4562 Depreciation and Amortization. I was a California resident for the period of. Whilst a standalone second mortgage is opened subsequent to the primary.

Repair costs such as materials are usually deductible. If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I. Here are the types that you need to know.

AmortizationCasualty LossNonrecurring Expenses Line 19 5. The main way a rental property can make money is through cash flow. In order to make an amortization schedule youll need to know the principal loan amount the monthly payment amount the loan term and the interest rate on the loan.

Tenant At Property No. Depending on the time at which the second mortgage is originated the loan can be structured as either a standalone second mortgage or piggyback second mortgage. Its not 100 exhaustive as there are a few obscure tax deductions that only apply to a few landlords but think of this as a rental property deductions checklist for the average landlord.

Line 8 Before 2021. The tenant details include. Remember people are looking for a place to call home.

Up to 80 cash-out refinance 85 on purchase. Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100 business meal deduction for food or beverages if provided by a restaurant includ-. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

1 Section 11 RELIGIOUS FREEDOM Absolute freedom of conscience in all matters of religious sentiment belief and worship shall be guaranteed to every individual and no one shall be molested or disturbed in person or property on account of religion. Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E. Here are the key elements to include in a rental ad when you list your house for rent online.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Form 4562 Depreciation and Amortization. Permanent Address of the tenant apart from the rented property.

If you itemize your deductions include your mortgage interest and mortgage insurance premiums if you use the property as your main home or second. Since I have rental property TurboTax keeps my records from year to year making filing taxes easy. If youve decided to hire a property management company or youre changing management companies go over your property from top to bottom and document the condition before the company comes in.

Self-Employed defined as a return with a Schedule CC-EZ tax form. If you became a nonresident during taxable year 2021 use December 31 2020 as your. Report your not-for-profit rental income on Schedule 1 Form 1040 line 8.

If you have more than three rental properties use multiple Schedule Es. Track your rental finances by entering the relevant amounts into each itemized category such as rent and fees in the rental income category or HOA dues gardening service and utilities in the monthly expense category. Types of Amortization Schedule.

Enter the start date and end date. Email address of the tenant. 12 rental investment Reports Pre-built and professional investment reports that summarize your Rental Investment Analysis Results so you can create professional investment reports for your business partners lenders.

This includes property owned directly or indirectly through a trust or other entity. Second mortgages commonly referred to as junior liens are loans secured by a property in addition to the primary mortgage. Simply put this is the difference between the rent collected and all operating expenses.

Our amortization calculator will do the math for you using the following amortization formula to calculate the monthly interest payment principal payment and outstanding loan. The type of amortization schedule on excel depends on how frequently interest is compounded on the loan ie. The very last item on the page is Dispose of Rental Property Assets.

Mortgage loan basics Basic concepts and legal regulation. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. Online competitor data is extrapolated from press.

The downpayment needed for the mortgage was 20 of the purchase. Monthly weekly or daily. For information about repairs and improvements and depreciation of most rental property refer to Publication 527 Residential Rental Property Including Rental of Vacation Homes.

Amortization Vs Depreciation What S The Difference My Tax Hack

What Is Schedule E What To Know For Rental Property Taxes

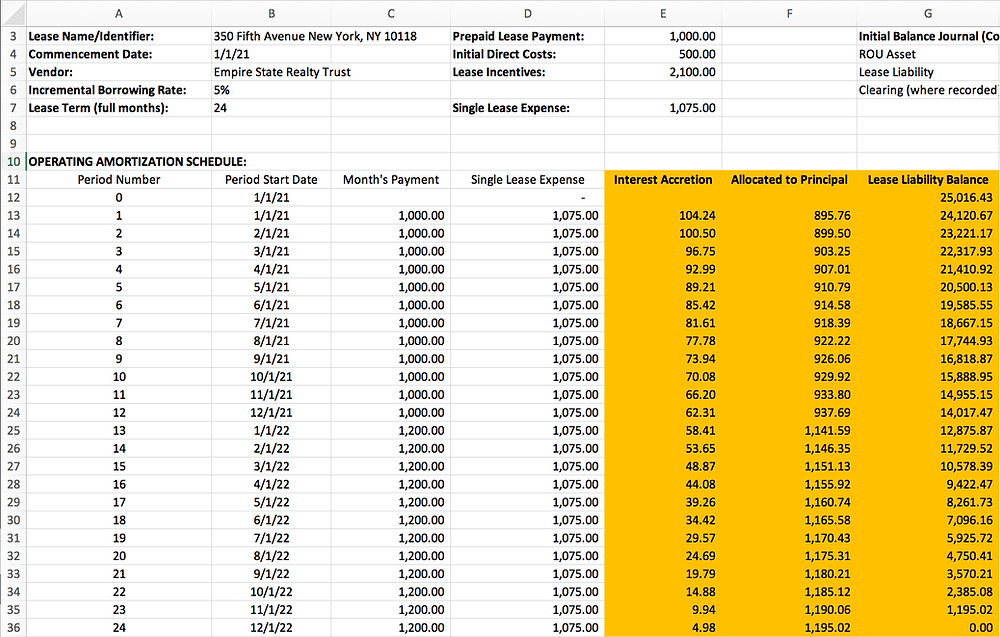

Asc 842 Lease Amortization Schedule Templates In Excel Free Download

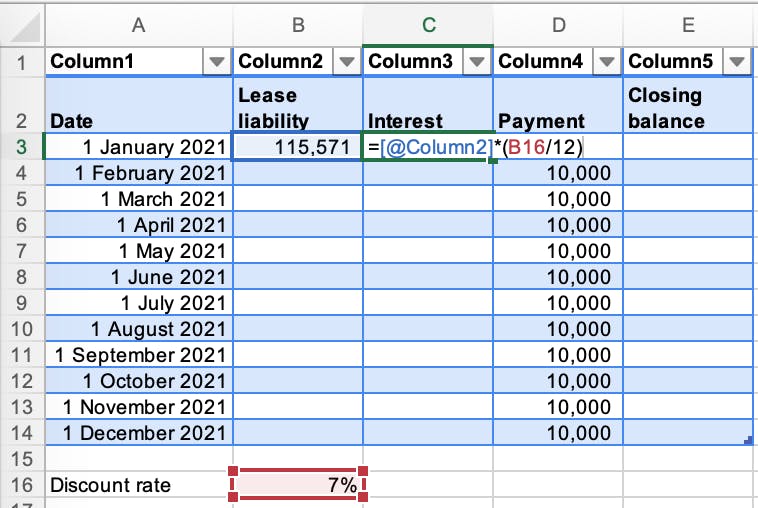

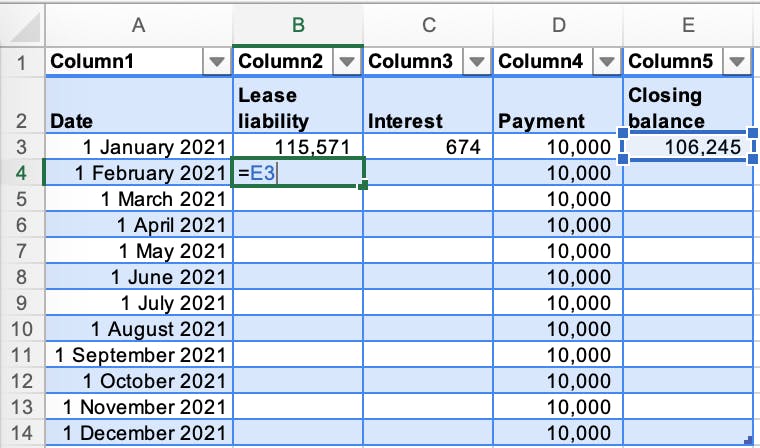

How To Calculate A Monthly Lease Liability Amortization Schedule In Excel

Lease Liability Amortization Schedule Calculating It In Excel

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

Rental Property Depreciation Rules Schedule Recapture

How To Calculate A Monthly Lease Liability Amortization Schedule In Excel

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Part 2 How To Prepare A 1040 Nr Tax Return For U S Rental Properties

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Free Macrs Depreciation Calculator For Excel

How To Prepare Depreciation Schedule In Excel Youtube

Lease Liability Amortization Schedule Calculating It In Excel

Depreciation Schedule Template For Straight Line And Declining Balance

Rental Property Depreciation Rules Schedule Recapture

4562 Listed Property Type 4562